2024 Spring Outlook

Planning for Change When Change is Uncertain

Looking Ahead In January last year, many financial professionals were bemoaning the fact that:

- Inflation was at its highest level since the 1980s.

- The Fed had raised interest rates from nearly 0% at the start of 2022 to more than 4% by the end of the year.

- The stock market was down and could decline even further.

- It seemed as if a recession was clearly on its way.

Which one of these laments turned out to be unjustified?

Much to the delight and surprise of yesterday’s naysayers, thus far, 2024 featured lower inflation, stronger employment figures, and a robust stock market. The recession that many predicted seems to have been replaced by a soft landing.

And yet, uncertainty continues to abound. You can’t turn on the news without endless commentary on the upcoming presidential election. Our country continues to be divided politically, and the world is plagued by wars that threaten to spread beyond geographic boundaries. In this environment, it’s important to understand some of the changes that might take place and how to adapt to them before (or if) they occur.

Change #1: Estate planning may become more complex

The Tax Cuts and Jobs Act of 2017 may impact estate plans post-2025 and cause potential changes to the Lifetime Gift and Estate Tax Exemption.

Even if you’ve worked with an attorney and financial advisor to create a plan that reflects your wishes for a meaningful legacy, you may have to revise it considerably. That’s because the Tax Cuts and Jobs Act of 2017 that raised the Lifetime Gift and Estate Tax Exemption (currently $13.61 million per person or $27.22 million per married couple) is scheduled to sunset after 2025. If Congress doesn’t vote to change or eliminate this expiration provision, the Exemption will be cut to the 2011 exemption level of $5 million plus inflation (likely around $7 million after 2025), at the beginning of 2026.

What might this mean to you?

- Currently, only the wealthiest citizens are liable for federal estate tax. If the exemption is lowered to the 2011 exemption level of $5 million plus inflation (likely around $7 million after 2025), many more people will be subject to estate tax that can erode the legacy they hope to leave by as much as 40%.

- Trusts might play a greater role in your estate plan if you are among those affected by the reduced gift and estate tax exemption. Trusts can remove assets from your estate while providing you with a degree of control over how your legacy will be used.

- Gifts are another way to reduce your taxable estate and witness the joy you bring to gift recipients while you are still alive. Currently, you may give up to $18,000 a year ($36,000 for married couples) to each recipient without incurring gift tax. Gifts above that amount reduce your lifetime gift and estate tax exemption.

A couple of considerations when developing or revising your plan:

- Trusts may be useful in reducing your estate and, therefore, your estate tax liability, but they can be a formidable obstacle if you or your spouse need the assets you place in them. Some trusts offer greater access than others. A spousal lifetime access trust, for example, enables your spouse to receive distributions upon request.

- Gifts may also prove a viable way to reduce your estate while enriching your loved ones, but ask yourself if you would make your gift for reasons other than reducing your taxes. You should also think about liquidity – would you have the cash you need to meet unforeseen expenses?

- Gifts used for medical or education expenses are not subject to gift tax, no matter how large they are. The key, however, is not to give these assets directly to a child or other recipient. Tax liability can be avoided only if you pay these expenses directly.

Change #2: The stock market may decline this year...or not

Change #2: The stock market may decline this year...or not

Presidential election years historically favor the stock market, but performance isn't tied to the winning candidate. Despite the S&P500's 10% average annual return since 1926, it achieved a 10% return only twice. The recent market upswing may not persist, so how can you prepare for the unpredictable?

Historically, presidential election years have been favorable for the stock market. However, performance has not been related to which candidate wins. Furthermore, the S&P 500 has averaged a 10% annual return since 1926. Do you know how many years that index has actually generated a 10% return?

Twice.

In short, the recent upswing in the market cannot be counted on to continue…even though it might. How do you plan for what seemingly can’t be planned for?

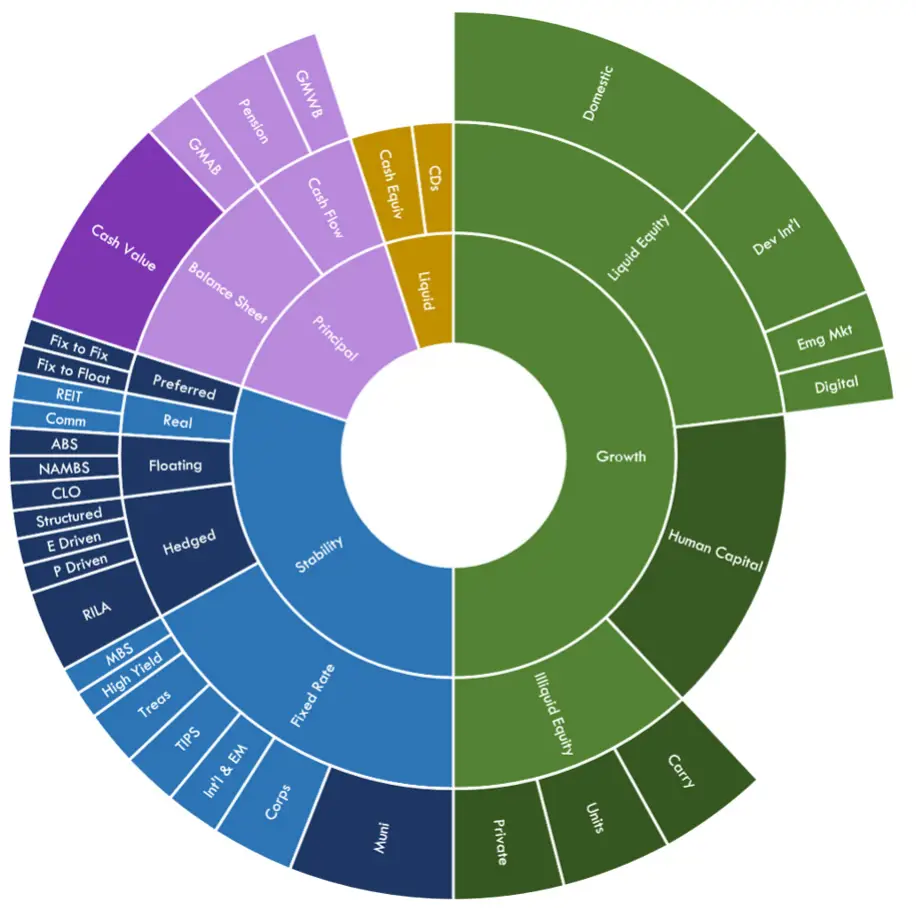

Consider more than stocks, bonds and cash when allocating assets

A landmark financial study1 concluded that asset allocation is by far the most important determinant of portfolio performance – even more important than securities selection. In today’s market, however, investors have far more choices available to them than when this study was written.

This chart illustrates the many options available to investors seeking growth, stability, liquidity, or safety of principal. For example, look at the green segment of the circle labeled growth. This category has traditionally been represented by stocks and chances are your portfolio contains what you might believe to be ample diversification of these investments – mutual funds and target-date funds, for example. In our opinion, however, diversification goes much further. Look at the green band that is concentric to the growth segment of the circle. As you’ll see, it is divided into three more segments – liquid equity, illiquid equity, and human capital. Liquid equity is further divided into such segments as Domestic and International, while Illiquid is divided among Private, Units, and Carry.

Which of these categories should you focus on? That’s a question you should be discussing with your advisory team. They can help you determine whether your allocation should be adjusted to include some of these choices. In addition, your team can help you adapt your allocation when your needs change and/or market conditions warrant.

Don’t overlook tax diversification

It’s an old adage in investing circles that “It’s not what you make; it’s what you keep.” Taxable accounts may offer a wide range of investment choices, including stocks, bonds, mutual funds, and real estate, but they also require you to invest with after-tax dollars and pay taxes every year on any income you earn or capital gains you realize. As a result, you may also want to consider allocating assets to:

- Tax-free accounts like Roth IRAs provide you with the ability to invest with after-tax dollars but pay no income or capital gains tax on any withdrawals you make. Other tax-free vehicles include whole, universal, or variable life insurance. In addition, municipal bonds offer income that is free from not only federal income tax but state income tax if they are issued in the state where you reside.

- Tax-deferred accounts like 401(k) plans or traditional IRAs. These accounts offer tax-deferred growth but require you to pay tax on any withdrawals you make. What’s more, withdrawals are taxed as ordinary income.

How can you implement a tax diversification strategy, especially if most of your assets are either in a taxable or tax-deferred account?

- Be tax-aware. Understand what tax bracket you’re in and how short- and long-term capital gains are taxed.

- Recent rises in the stock market may have generated gains in your taxable portfolio. Determine whether you have any losing positions. By selling them, you can use your losses to offset any gains for tax purposes. One other thing – if your losses exceed your gains, you can deduct up to $3,000 against ordinary income and carry forward any remaining losses for use in subsequent years.

- Think about making your charitable contributions with appreciated stock positions instead of cash. By doing so, you remove unrealized capital gains from your portfolio.

- Determine whether your employer offers a Roth 401(k) that allows you to make contributions with after-tax dollars and make tax-free withdrawals at retirement.

- Consider converting any traditional IRAs to Roth IRAs and whether incurring tax liability now is worth the prospect of being able to make tax-free withdrawals at retirement.

- Finally, seek professional guidance before you make decisions you might regret later. Tax diversification can be complex and requires a thorough understanding of tax codes and your overall financial situation.

Think about cost

Recent headlines in the financial press have proclaimed that “stock picking is back in favor.” In other words, actively managed investments might be a better alternative in today’s climate than passively managed, index-based vehicles.

Since 2001, however, only one-third of actively managed were able to outperform the S&P 500 in an average year. In 2023, what did actively managed do to warrant such favorable press?

One-third of them were able to outperform their passively managed and less expensive counterparts.

In short, nothing had really changed. Does this mean that you should confine your investment activities to passively managed strategies? Not necessarily. Sometimes, the cost is worth it, especially when participating in portfolios with less market-efficient asset classes. Again, discuss this issue with your advisory team and determine whether the cost of implementing your asset allocation is in line with its goals.

Look beyond your portfolio to help hedge potential market volatility

What goes up can most definitely come down, but even if the market reverses its recent upward trend, there are options available to help you reduce risk. Whole life insurance policies, for example, offer cash value that is guaranteed to grow at a minimum rate. Registered Index Linked Annuities (RILAs) are insurance-based vehicles that offer index-linked market performance and sometimes a degree of downside protection. Finally, Fixed Index Annuities (FIAs) also link returns to a market index and impose no risk of loss in return for limited upside potential (typically high single digit % or more, depending on which FIA you choose).

Change #3: The insurance climate is changing

Change #3: The insurance climate is changing

The fires, floods, and tornados that have plagued many parts of our country have had a troublesome side effect on people who may not live anywhere near the affected areas.

Premiums for property and casualty insurance have gone up, and in areas where natural disasters have occurred, some carriers are no longer offering coverage. Before you renew your current coverage, consider comparing it to coverage offered by other providers.

NFP has recognized the need for protection against this rapidly growing threat and offers cyber solutions that encompass identity theft, account takeover, smart home device breaches, cyber harassment, and other technology-related crimes. Consult your advisory team for more information.

A Word about Long-Term Care Insurance

Recognizing that the government can’t pay the bill for long- term care, a growing number of state tax codes now offer tax incentives to encourage you to take personal responsibility for your future long-term care needs. In addition, the state of Washington passed a law in 2022 requiring residents to own a long-term care insurance policy or purchase coverage through a payroll withholding tax of 58 cents on every $100 earned. The law went into effect last summer and will provide residents with a lifetime benefit of $36,500 to pay for extended care costs.

Approximately a dozen other states are considering comparable legislation, including New York, Pennsylvania, and California. To avoid this proposed payroll tax, you must show evidence that you own a long-term care policy. Considering the lack of coverage offered by proposed state programs and the reduction of take-home pay you will incur as a result of any legislated payroll tax, now may be a good time to look into the wide variety of long-term care policies available in today’s marketplace. Many offer not only meaningful protection but the flexibility to leave your loved ones a death benefit in the event you don’t require all your coverage for long-term care expenses.

For many people who have purchased long-term care policies in the past, the idea of being able to provide loved ones with a death benefit is appealing, but does that mean you should get out of the long-term care policy you bought years ago in favor of a new one?

Not necessarily. Older polices tended to provide choices that newer ones don’t - amount of coverage, how long coverage will last, how long is the waiting period before coverage begins, will coverage be adjusted for inflation, etc. On the other hand, they are relatively expensive, and premiums can be raised periodically. Before you make a decision you might regret, talk with your advisory team and get the guidance you need to determine your best options.

While you’re at it, consider the following points:

-

Does your policy offer named peril or all-risk protection? Named peril specifies the conditions you are protected against, while all-risk protects your home against all damages except those listed in the policy. To protect yourself against these prohibited conditions, you may have to purchase a separate policy. Still, all-risk coverage may be well worth the additional cost over its named peril counterpart for the added protection it provides.

-

Will you receive replacement cost or actual cash value for losses you incur? Actual cash value coverage factors in depreciation when determining payment for your damaged or stolen property. As a result, you may not receive enough to replace that property with a new equivalent. Replacement cost protection may exact a higher premium, but it will pay the actual cost of replacing your property with no depreciation adjustment.

-

Are you covered against floods? There has been a deluge of flood insurance claims over the last several years in areas of the country without a history of frequent flooding. Flood insurance is offered by the National Flood Insurance Program, a division of FEMA. By purchasing a single peril policy in addition to your homeowners policy, you can protect yourself to a degree from flood damage to your home and its contents.

-

What about cyber-crime? Another reason for rising insurance premiums is the proliferation of identity theft and other technology- related crimes. Americans lost more than $12.3* billion to internet crime last year, according to an annual report from the FBI. Almost as troubling is the fact that even those who have not been victimized are concerned that they might be. Consider that:

- 92% of Americans are concerned about a cyber breach.

- 56% don’t know what steps to take in the event of a data breach.

- 422 million people had their data compromised by cyber criminals.

Change #4: Making financial decisions without professional guidance is becoming more difficult

In a world of constant change, professional advisors recognize the challenges faced by clients navigating the complex financial landscape. From time constraints to emotional decision-making, individuals often benefit from expert guidance in managing their assets strategically and holistically.

In an environment characterized by change, one thing remains constant. Today’s complex financial landscape is no place to go it alone.

As professional advisors, we understand that:

- Clients share a similar dilemma: They don’t have the time, inclination, or experience to manage their assets on their own. Often, they are consumed by their careers or family obligations and have little time remaining for anything else.

- Investors too often let emotions rule their financial decisions.

- Many people tend to compartmentalize their financial concerns and address them individually without an overarching plan.

We are committed to providing our clients with comprehensive, personalized guidance that encompasses not only their investments but also virtually every aspect of their financial lives. Retiring as planned and without compromise; leaving a legacy without excessive taxation or family conflict; mitigating unforeseen risks that could jeopardize your family’s security – You can depend on your advisory team to understand who you are as a person, as well as an investor, and provide you with the advice you need to make more informed decisions and meet even your most challenging financial aspirations.

1Brinson, Hood and Beebower, Determinants of Portfolio Performance, Financial Analysts Journal, July/August 1986 and Brinson, Singer and Beebower, Determinants of Portfolio Performance II, Financial Analysts Journal, May/June 1991

CRN202703-6095871