If you were particularly happy to see 2022 come to an end, you were not alone. Inflation was at its highest level since the 1980s. The Fed raised interest rates seven times and in higher increments than usual. Markets declined in unison, with the S&P 500 dropping more than 18% and the Bloomberg Aggregate Fixed Income Index down 13% - the first time that both stock and bond markets declined in the same year since 1969.

To add to the confusion, rising gas prices, the war in Ukraine, tension in our relationship with China, and of course, the continuing threat of Covid contributed to the uneasiness that many Americans felt as 2022 came to a merciful end.

As for 2023, however, that uneasiness still remains; Regional bank concerns, the second and third-largest bank collapse in U.S. history, a polarized political landscape, and more. Many are left wondering if Congress, which is equally divided, will be able to pass any meaningful legislation this year and if financial regulators can adequately address any structural risks to our economy.

And yet, there is good news this year for those who look beyond the headlines. Employment is strong, and so are corporate earnings. Some economists believe that we are still recuperating from the economic effects of the pandemic when too few goods were available to absorb the trillions of dollars in stimulus money that were injected into the economy. This imbalance will hopefully pass as supply and demand become more equally weighted.

Given this uncertainty, what can you do to expect the unexpected? As always, we urge you to stay in close touch with your team at Lenox Advisors and contact us if you have any questions about what you read on the following pages.

Estate Planning & Tax Strategies

Important Ways To Save On Taxes Are Now In Effect For 2023

Inflation may actually benefit some taxpayers as the IRS has adjusted tax brackets to account for today’s environment. For example, married couples filing jointly with adjusted gross income (AGI) of $350,000 in 2022 are now in the 32% tax bracket. If their AGI is the same this year, they will be in the 24% bracket when filing their taxes in 2024.

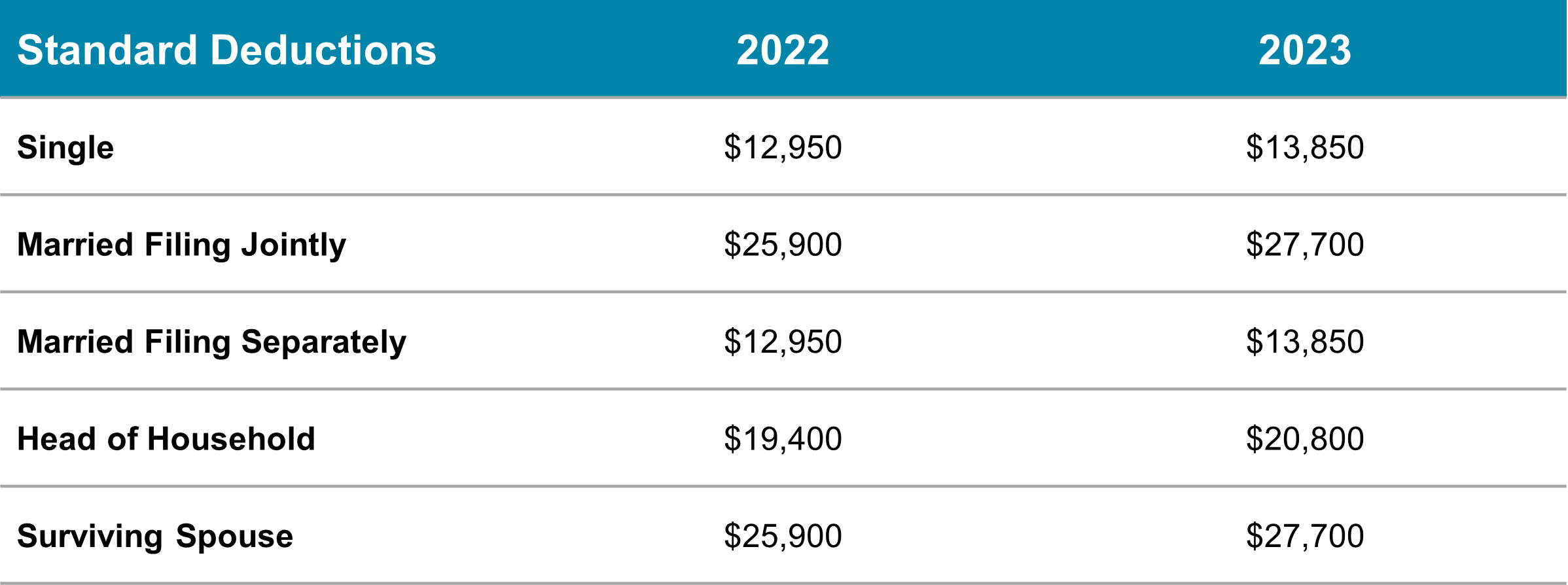

In addition, the standard deduction has increased as follows:

And yet, for many, unfortunately, the state and local tax deduction (SALT) cap remains at $10,000, which is especially bad news for taxpayers in states with high income and property tax. The good news, perhaps, is that the current $10,000 SALT cap is scheduled to expire at the end of 2025, along with other provisions of the Tax Cuts and Jobs Act of 2017. The not-so-good news is that if the provisions of this tax law really do expire, the generous lifetime estate tax exemption of $12,920,000 will be reduced by half. Again, keep in touch with your team at Lenox Advisors to determine whether Congress acts to change the status quo.

Gifts & Charitable Contributions

The annual gift exclusion increased from $16,000 to $17,000 per person this year. That means that a married couple can give up to $34,000 to a child or other individual without incurring gift tax. If you do go over the exclusion limit, you’ll have to file a gift tax return, but that doesn’t mean you will have to actually pay tax. Gifts in excess of the annual exclusion will be debited from your lifetime gift and estate tax exemption of $12,920,000. Again, however, this lifetime exemption is scheduled to be reduced by half after 2025, so if you’re contemplating making a large gift to someone, now is the time to do it.

A few more important points:

- Charitable contributions do not count toward your annual gift tax exclusion or lifetime gift and estate tax exemption.

- If you’re age 72 or older, you can directly transfer up to $100,000 from your IRA custodian to a qualified charity. You will get a charitable deduction, and your distribution will count towards satisfying your Required Minimum Distribution (RMD) requirement. If you’re between ages 70 ½ and 72, you are no longer required to take Required Minimum Distributions each year, but you may still direct distributions of up to $100,000 from an IRA to the charities of your choice. These distributions will not count as income on your tax return.

- Consider making your contributions with appreciated stock positions instead of cash. By doing so, you remove unrealized capital gains from your portfolio.

- Bunching contributions - i.e., combining contributions you were planning to make this year and next year – may enable you to exceed the standard deduction on your tax return and itemize instead. The result may be a lower tax bill than you would have incurred otherwise.

- If you pay for an individual’s medical or education expenses and you write checks directly to the institution, your payment is not considered a gift, and there is no limitation on your contributions.

Retirement Planning

2023 Will Introduce A Series Of Changes In Retirement Planning

The Secure Act 2.0 was passed by Congress at the end of last year. This new legislation picks up where its predecessor, Secure 1.0, left off. It will make it easier for plan sponsors to administer their retirement plans, and it will provide Americans with greater access to retirement plans and greater opportunities to save more for retirement. Some of the highlights include:

- IRA and other qualified plan participants no longer have to begin taking Required Minimum Distributions (RMDs) at age 72. The age has been increased as follows:

- Age 73 if you’re turning age 72 in 2023.

- Age 74 if you were born between 1951 and 1950.

- Age 75 for if you were born in 1960 or later.

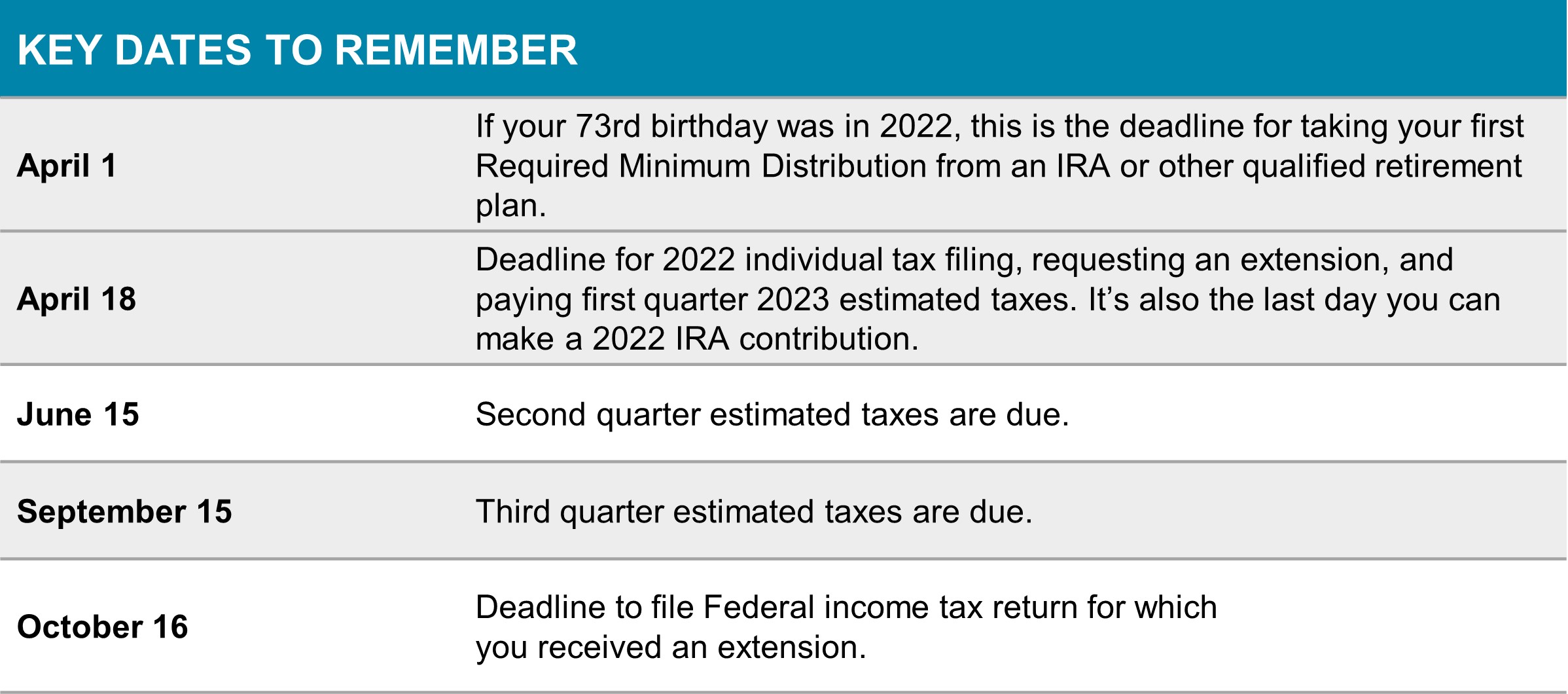

In all cases, you must take your first RMD by April 1st of the year following your birthday year. If you turned age 72 last year and are taking your first RMD, nothing changes. You must continue to take RMDs on an annual basis.

- The penalty for failing to take an RMD on time has been reduced from a 50% excise tax to 25%. For example, if you withdrew only $2,000 of a $10,000 RMD, you would have been subject to a 50% excise tax on the remaining $8,000 ($4,000). Under the new law, your penalty would be 25% of $8,000 or $2,000.

- Employer contributions to your 401(k) plan may now be treated as Roth contributions, provided you are fully vested. In other words, you will be able to withdraw these contributions and any investment earnings they accrue without tax liability at retirement.

- Employers will be able to offer SIMPLE IRAs and SEP-IRAs as Roth IRAs if they wish. Participants will contribute after-tax dollars to these plans but achieve tax-free growth and withdrawals at retirement.

- If you participate in a Roth 401(k), you will no longer be required to take RMDs, beginning in 2024. Any in-plan Roth amounts will be subject to the same rules as Roth IRAs. RMDs will not be required during your lifetime, and you will be able to leave your assets in the plan if you wish when you separate from service.

- If you participate in a 401(k), 403(b), or 457(b) plan, you may be able to increase your catch-up contributions to $10,000 annually ($5,000 for SIMPLE 401(k) and SIMPLE IRA participants) when you are between the ages of 62 and 64. These catch-up contributions will be adjusted for inflation each year, but they must be made with after-tax dollars, similar to Roth 401(k) or Roth IRA contributions. When you retire, you will be able to make qualified withdrawals of these after-tax contributions and any returns they earn without incurring tax liability. Ask your employer whether your plan will offer this new benefit.

There’s more to Secure 2.0 – in fact, much more. Confer with your team at Lenox Advisors to determine which of these new laws many provisions affect you.

More Ideas to Consider

- 529 Plans will offer additional flexibility beginning in 2024. Any assets in a 529 that are not used for education expenses can be rolled over to a Roth IRA. To take advantage of this benefit, you must own your 529 for at least 15 years – another good reason to get started as soon as possible after the child in your life is born.

- If you realized losses in 2022, like many investors, you are probably aware that they can be used to offset capital gains for tax purposes. What you may not realize is that if losses exceed gains, you can deduct up to $3,000 against ordinary income and carry forward any remaining losses for use in subsequent years.

- Contribution and income limits for IRAs and Roth IRAs have changed:

- If you have a traditional IRA, now might be a good time to consider converting it to a Roth IRA. You will not be subject to the income limits above. In addition, the down markets of 2022 may have reduced the value of your IRA assets, but they have also reduced the taxes due when you make your conversion. By employing this strategy, you will be able to withdraw assets at retirement with no tax consequences and avoid taking Required Minimum Distributions every year beginning at age 72, 73, 74, or 75, depending on when you were born.

Risk Management

Life Changes Constantly, And Your Insurance Needs To Change With It

According to a major investment firm, a 65-year-old couple retiring last year could expect to spend an average of $315,000 in healthcare costs over the course of their lifetimes.1 This projection seemed shocking enough until a footnote revealed that this $315,000 did not include dental, vision, and long-term care expenses; It also assumed that the couple was enrolled in Medicare Part A, which covers hospital stays; Medicare Part B, which covers doctor visits, lab tests, and other medical services; and Medicare Part D, which covers prescription costs. However, it did not assume that the couple was enrolled in a Medicare Supplemental or Medicare Advantage Plan, which would have picked up a meaningful percentage of the projected healthcare costs.

We urge you not to make the same mistake as retirement approaches and you near age 66 when you are first eligible for Medicare. Your team at Lenox Advisors can help you understand the options available to you. Please don’t hesitate to reach out to them so you can make the most informed decisions possible. In addition, we suggest that you protect yourself from the expenses that this $315,000 doesn’t cover – expenses that could run considerably higher and threaten your family’s financial security.

Protection from Long-Term Care Expenses

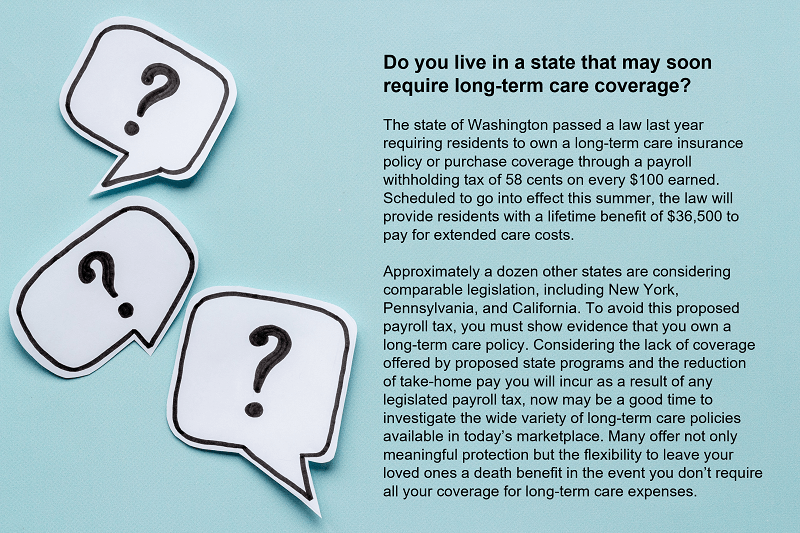

Long-term care can take a number of forms – nursing home, assisted living facility, home, and/or community care services. Depending on where you live, costs can differ greatly, but a major long-term care insurance provider projects that average annual costs can run from $53,768 to $105,850.2

Medicare only pays for a maximum of 100 days in a skilled nursing facility if you need physical therapy, occupational therapy, or other skilled care after a qualifying hospital stay. It does not pay for custodial care in the event you need assistance dressing, eating, bathing, or performing other basic life functions. For these expenses, many people have relied on long-term care insurance, but policies have changed greatly over the years. Today’s long-term care policies generally combine long-term care coverage with whole life insurance. If you don’t require long-term care, your beneficiary receives a death benefit. Also, if you do require long-term care and your expenses do not exceed your death benefit, your beneficiary will receive the remainder.

For many people who have purchased long-term care policies in the past, the idea of being able to provide loved ones with a death benefit is appealing, but does that mean you should get out of the long-term care policy you bought years ago in favor of a new one?

Not necessarily. Older policies tended to provide choices that newer ones don’t - amount of coverage, how long coverage will last, how long is the waiting period before coverage begins, will coverage be adjusted for inflation, etc. On the other hand, they are relatively expensive, and premiums can be raised periodically. Before you make a decision you might regret, talk with your Lenox team and get the guidance you need to determine your best options.

1Fidelity Retiree Health Care Cost Estimate, Fidelity Management Research, 2022.

2Genworth, Health Care and Long-Term Care Costs in Retirement (2023) (annuityexpertadvice.com)

Protection from Unforeseen Medical Expenses

If you are retired, and on Medicare, you have hopefully opted for a Medicare Supplemental Plan (also known as Medigap) or a Medicare Advantage Plan that will help pay for costs not covered by Medicare Part A and Part B. If you’re still working and not covered by Medicare, you are hopefully covered by an employer healthcare plan that has left you with no unpleasant surprises when paying for medical expenses.

If this is not the case, perhaps you should take a closer look at the plans offered by your employer:

- High Deductible Insurance Plans require you to pay for medical expenses out-of-pocket until you reach a specific annual dollar amount. Depending on the plan, that amount can run between $1,500 and $7,500 for an individual or $3,000 and $15,000 for a family. In return, monthly premiums for high deductible health plans are relatively low.

- Preferred Provider Organizations charge considerably higher premiums but typically impose lower or even no deductibles. You can visit doctors in or outside of a network without a referral from a primary care physician. Co-pays and/or co-insurance, however, may be in effect.

Clearly, PPOs offer greater flexibility, while High Deductible Plans generally offer lower costs…provided you don’t have medical conditions that necessitate numerous visits to doctors or hospital stays.

If you are healthy and see a doctor once a year for a checkup, you might consider a high deductible plan. Many of them actually cover annual checkups without a deductible. If you have chronic medical conditions or are simply hesitant to count on continuing good health, you might find greater peace of mind by enrolling in a higher-cost PPO. But those are not the only options; there is a middle ground.

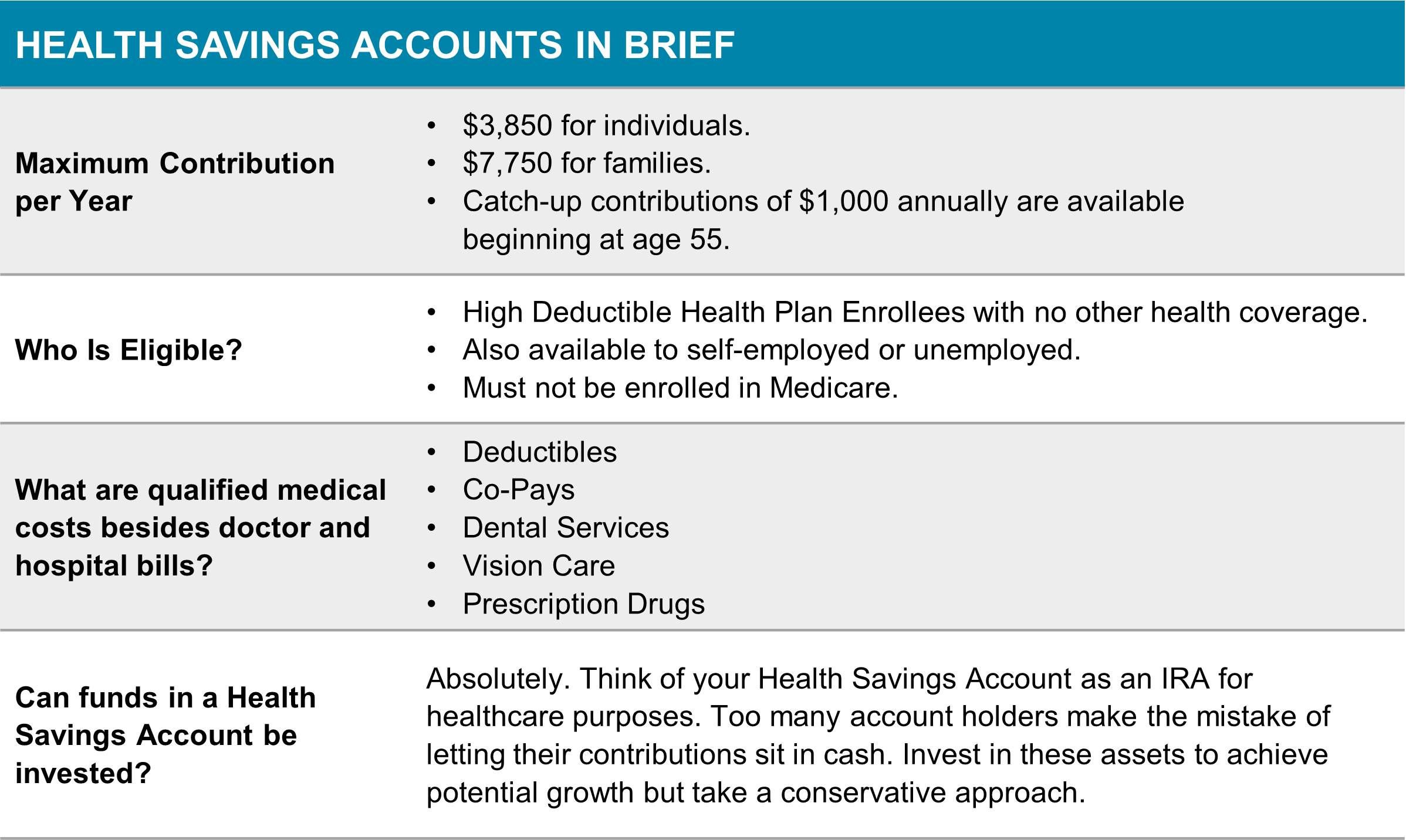

Many employers offer Health Savings Accounts that have proven popular with participants in High Deductible Health Plans. These accounts work a little like 401(k) plans in that contributions are deducted from your paycheck on a pre-tax basis and allowed to grow tax-deferred. When you use plan assets for qualified medical expenses, you pay no income tax on the withdrawal. This approach enables you to benefit from the lower cost of a High Deductible Plan while providing you with funds for unanticipated medical bills.

A word of caution – if you use plan assets for anything other than qualified medical expenses, your withdrawals are subject to income tax, plus a 20% penalty. Once you reach age 65, however, you may use plan assets for any purpose you wish without the penalty (income tax still applies).

Health Savings Accounts are only available to employees who enroll in a High Deductible Health Plan. If your employer doesn’t offer a Health Savings Account, you may be able to enroll in one through a financial institution.

Adding Flexibility to Flexible Spending Accounts

Many employees are familiar with Flexible Spending Accounts that enable them to set aside funds for healthcare expenses on a pre-tax basis. Unlike Health Savings Accounts, Flexible Spending Accounts are available to all employees, regardless of whether they are covered by High Deductible, PPO, or any other health insurance plan. Also, unlike Health Savings Accounts, funds contributed to a Flexible Spending Account must be used in the same year. Otherwise, they can’t be used at all; in other words, use it or lose it.

What you may not know about Flexible Spending Accounts is that:

- Generally, you cannot enroll in both a Flexible Spending Account and a Health Savings Account. However, there is a special type of Flexible Spending Account that can only be used for dental and vision expenses. This Limited Purpose Flexible Spending Account is available to Health Savings Account enrollees and can provide them with additional funds to meet such expenses as eyecare exams, contact lenses, dental cleanings, x-rays, and root canals.

- Dependent Care Flexible Spending Accounts aren’t available through all employers, but if you’re fortunate enough to have access to this benefit and you have children, you should consider enrolling and contributing as much as you can up to the maximum of $5,000 for single tax filers or married couples filing jointly. That’s because Dependent Care Flexible Spending Accounts offer the ability to pay for childcare with pre-tax dollars – that means daycare, nursery school, nannies, day camp, and other related services.

PROTECTION BEYOND HEALTHCARE

Permanent Life Insurance

As its name implies, Permanent Life Insurance offers coverage for your whole life. Permanent life Insurance offers several benefits both while alive and upon death.

- Provide your beneficiaries with a tax-free death benefit.

- Accumulate cash value on a tax-deferred basis with the ability to create tax-free distributions.

- No limit on contribution requirements imposed by the IRS for 401k, IRAs, and other qualified plans.

- Choose from a variety of policies that offer guaranteed and/or variable returns.

- Additional policy benefits can provide tax-free cash flow for long-term care expenses in the home, assisted living, or nursing home.

Whole life insurance proves especially beneficial in today’s higher interest rate environment. Historically as interest rates rise, the insurance carrier’s dividend will rise along with it. Cash value and death benefit performance of the policy never decline in value based on market performance from one year to the next, creating stable and predictable growth as well as distributions during your lifetime.

Disability Income Insurance

If you’re fortunate enough to work for an employer that offers a long-term disability plan, it’s important for you to know the following:

- How much your policy will pay if you’re out of work? Do your disability benefits equal your monthly spending, college savings, and retirement contributions?

- Is your disability insurance portable? If you leave your employer, can you take it with you?

- Are your disability benefits taxable? They are if your employer pays for the insurance premiums on your behalf.

Property & Casualty Insurance

Equally important to building assets is having a plan to protect them. Review your property & casualty policies annually to ensure your plan still fits your needs.

- Homeowner’s Insurance

- Are your dwelling and personal property covered on an all-risk basis? (All causes of loss (perils) are covered unless specifically excluded).

- Do you have full replacement coverage?

- Are your multiple and/or international properties coordinated?

- Auto Insurance

- Did you add and remove new vehicles or drivers properly?

- Do you have enough liability coverage?

- Review medical coverage (medical can affect your coverage).

- Umbrella Insurance

- Is your umbrella coverage equal to your net worth?

- Do any liability gaps exist between your homeowners/auto and umbrella policies?

- Are your Living Trust and/or any LLCs named as an “additional insured” to cover assets titled to them?

- For your Domestic employees, did you consider the workers’ compensation law? Is there a need for “employment practice liability” coverage?

- Are memberships on profit and not-for-profit boards reviewed for personal liability risks?

- Cyber & Identity Theft Protection

- Do you have Credit and Identity monitoring in place? How often do you monitor reports?

- Should an incident occur, are you prepared to respond and mitigate further risks?

- Does your coverage include immediate expenses, as well as ongoing expenses like lawsuits and legal claims?

Asset Management

A Bad Year For The Economy, A Better Year For Markets

It’s no secret that both the stock and bond markets performed poorly last year. How poorly?

The S&P 500 was down more than 18%, while the Bloomberg Aggregate Bond Index declined by 13%. 2022 marked only the second time since 1936 that both the stock and bond markets declined for the year. The first time was in 1969 when stocks were down 8.4% and bonds 0.74%.

Why the historically poor performance?

Certainly, inflation was a major contributor, as was the Fed’s attempt to control inflation by raising interest rates seven times and in increments as large as 75 basis points.

What about 2023?

The Fed has already raised interest rates once in 2023 and will continue to do so in an effort to reduce inflation. So far, the medicine appears to be having the intended impact, as inflation has decelerated during the past several months. Another question plaguing investors is whether the debt ceiling will be raised. We make no predictions but take some comfort in the fact that the debt ceiling has been raised by Congress 78 times since 1960. In short, we’ve been here before.

As for the stock market, we urged investors last year at this time to carefully consider their exposure to U.S. growth stocks in favor of a balanced approach among growth, value, U.S., and non-U.S. positions. While value stocks were down 10% for the year, they outpaced growth stocks by a wide margin, with the latter down 30%. In addition, international stocks which lagged their U.S. counterparts for much of the year finished with a kick and actually closed the year with a slight lead on U.S. stocks for 2022.

Looking forward, we still believe that a diversified approach with a blend of growth, value, U.S. and non-U.S. is warranted. True, there are switching costs associated with reallocating your portfolio (taxes being a main consideration) that may or may not be offset by any assumed uptick in expected returns. For those anchored to the “U.S. growth” story of the last ten years, however, we would simply offer the following: many structural reasons support value stocks over growth, namely higher interest rates, higher inflation, and onshoring of supply chains. Further, periods in which value or growth outperform each other typically play out over the years, not a single calendar year. With respect to international investing, as has been the case for years, providers of Capital Markets Assumptions (CMAs) are once again predicting non-U.S. stocks outperforming U.S. stocks by multiple percentage points per year over a long-term horizon. Historically, relative valuation disparity drove most of the predictions for international stocks outperforming. Add to that what likely is now relative U.S. dollar weakness vs. other major currencies, and international stocks currently enjoy a brisk tailwind.

As for fixed income, last year’s 13% decline in the Bloomberg Aggregate Index was by far the largest since the index was introduced in 1976. While we’ve seen interest rates rise in larger increments than they did last year, we haven’t seen the rise in an environment where fixed-income yields were as low as they were in 2022. We often stress the strong relationship between fixed-income yields and subsequent long-term total return. With yields up from last year, we are hopeful that fixed- income portfolios will generate stronger performance in the months to come.

One of the firms publishing its CMAs the longest is JP Morgan. Last year, owing to the stretched valuations observed at that time, they were estimating long-term U.S. equity returns in the low 4%. Fast forward a year, and they are now predicting core, investment grade, fixed-income returns to be in the mid-4%s - greater than what equities were predicted to return just a year ago. The shift in that dynamic cannot be understated and will have broad portfolio and investment ramifications for the years ahead.

In short, the years since the recession of 2009 were a period in which interest rates declined to a point where fixed-income yields barely warranted investor attention. The scenario appears to be changing, with investors no longer wondering why they should allocate a meaningful portion of their portfolios to fixed-income, even though they were reluctant in the past to assume what they perceived to be the greater risk of equity investing.

Beyond Traditional Asset Classes

Alternative investments did their job in many cases, providing diversification that helped offset the poor performance of stocks and fixed income:

- Commodities finished the year in positive territory, although performance wasn’t positive across the board. Energy, as you can imagine, was well into positive territory, and so was grain, partially because of the war in Ukraine. Precious metals and industrial meals, however, showed lackluster results.

- Real estate performance and valuations depended on whether you were participating in private programs or publicly-traded vehicles. Toward the end of the year, headlines announced the suspension of redemptions for two of the leading private real estate funds. We think the mechanism built into these private real estate funds to suspend redemption provides the break necessary to reduce the risk of a broader systemic “run on the bank,” and as such, it is good for the ecosystem. While the near term may face speedbumps, we think the asset class remains attractive, earning 5%+ yields, provided that managers deploy prudent amounts of leverage and structural inflation mitigation.

- Private equity groups a number of disparate strategies under the same umbrella. Headwinds exist for all of them, albeit for different reasons and differently for previously committed capital vs. new commitments. Specifically, “buyout” typically connotes a debt-assisted purchase of a company. With interest rates now higher and likely for the foreseeable future, such purchases have become structurally more expensive. We are witnessing acquisitions going forward without debt, which on the one hand, shows deals can continue, though requiring more equity from the private equity sponsor. More expensive debt likely is an obstacle for both existing commitments to buyout equity and new commitments. Growth equity and venture, in contrast, typically do not lean on large quantities of debt to help fund an acquisition, but other headwinds currently exist – namely, their public sector peers have, for the most part, seen their share prices declined precipitously in 2022. These lower prices will force growth equity and venture investors to match the valuations in their still private investments. This is likely a hindrance for existing commitments but may provide fertile investing ground for new commitments.

- Private credit may experience choppier waters. With some analysts anticipating a recession, we wonder how resilient private credit borrowers will be, given that they are almost exclusively not rated by the credit agencies and are thus assumed to be below investment grade in credit quality; we think with distribution yields of 8-9%+. However, investors are being adequately compensated for the inevitable increase in defaults should a recession actually appear in the near term.

PDF Version

CRN202602-3894316