Trusts can help you address your most important concerns. You may be able to provide income for the people and places that matter most, while minimizing and places that matter most, while minimizing estate taxes and providing funds for estate settlement costs.

Irrevocable Life Insurance Trust (ILIT)

A common planning technique used to minimize estate taxes involves an Irrevocable Life Insurance Trust (ILIT). A properly structured and administered ILIT will not be considered part of your estate for inheritance/estate tax purposes- meaning your heirs won't have to pay estate or inheritance taxes on them.

Benefits

- May reduce both federal and state estate taxes by taking death benefit proceeds out of your estate.

- Provides liquidity at death to pay estate taxes or increase what beneficiaries receive.

- Protects the trust assets from creditors.

- Manages assets on behalf of the beneficiaries, with funds distributed in accordance to the terms of the trust.

Considerations

- The grantor cannot terminate the ILIT once it is established. However, with a properly drafted trust, the grantor's spouse or parents can have flexibility in adjusting the terms

- Assets in an ILIT are not available for the grantor's access or use.

- Transfers of assets to an ILIT may only be used for the benefit of trust beneficiaries.

How an ILIT Works

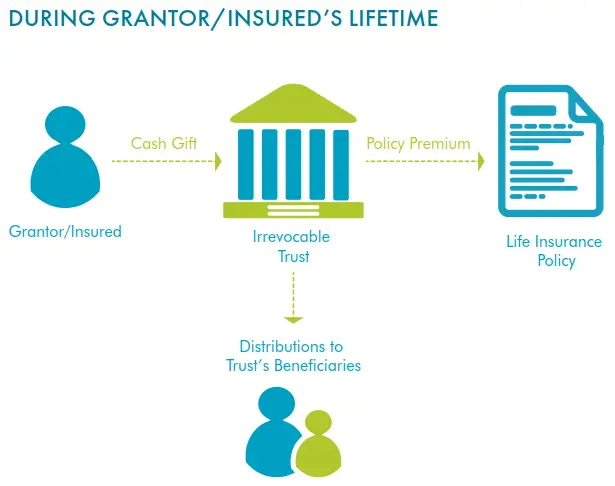

An ILIT is an irrevocable trust that purchases a life insurance policy on the person who set up the trust called the "grantor" or "insured." Typically, the grantor annually makes a gift in the amount of the policy's premium to the trustee. The trustee notifies the beneficiaries that they have an option to withdraw this gift from the trustee - Crummey powers. A typical Crummey withdrawal power lapses 30 days after the gift is made to the trust.

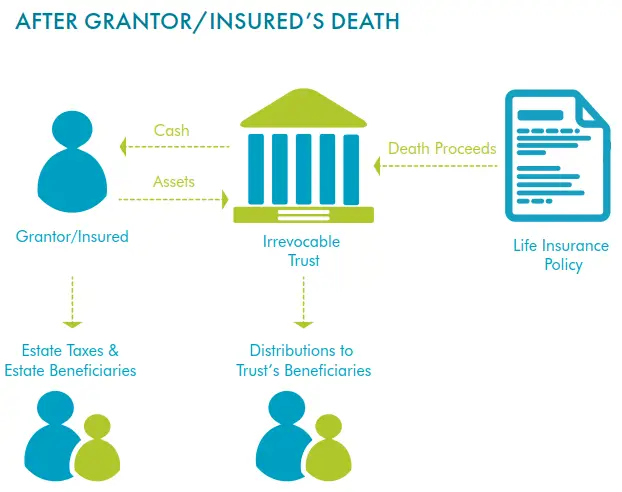

After the grantor's death, the trustee files a claim and receives the death benefits of the trust. The proceeds are then received, gift, income, and estate tax-free. This allows the trust to buy assets from the grantor's estate or satisfy any other liquid needs. The distributions are distributed to the beneficiaries in accordance with the terms of the trust.

Selecting a Trustee

A competent trustee is as important to the success of a trust as being well-drafted. Below are some duties and responsibilities to consider when making a selection:

- Administer the trust

- Be loyal, impartial and prudent

- Control and protect trust property

- Collect trust property

- Inform and report to beneficiaries

- Diversify investments

- Keep records and no commingling

- Enforce and defend claims

Naming Beneficiaries & Establishing Conditions

Beneficiaries are typically a spouse, child, relative, or friend that the grantor would like to leave money to after death. Establishing an ILIT allows the grantor to control exactly how, when and why beneficiaries receive the proceeds. Proceeds can be paid monthly, annually, or in one lump sum. The grantor can even dictate that beneficiaries will receive money when they attain certain milestones, for example, when a beneficiary graduates from college, buys a first home, marries, or has a child. If the beneficiary is on government aid, your trustee can carefully control how distributions from your policy are used in such a way as not to interfere with your beneficiary's eligibility to receive government benefits.

Conclusion

Ownership of a policy, as well as how the proceeds are held at payout, can have a significant impact on the post-tax estate left to one's family. Discuss an ILIT with your Lenox advisor to determine if it is right for you, and the best way to structure the ILIT based on your needs.

CRN202709-7546234